WHO WE ARE

We provide growth capital to technology entrepreneurs globally.

We leverage our deep, unrivaled global network to ensure we are the “Partner of Choice” for entrepreneurs looking for growth capital. Our highly integrated team works tirelessly to bring local perspective and market expertise.

OUR PHILOSOPHY

We are hands-on operators and entrepreneurs that are uniquely positioned to help advise and navigate all stages of growth. We understand the pains of growing a business and strive to be by the companies’ side throughout its journey.

We unlock untapped potential for growth stage companies to rapidly expand and fundamentally transform their businesses. The global technology ecosystem is quickly changing - its creative and innovative and entrepreneurship spirit has created new multi-billion-dollar markets and a fresh perspective to technology, internet, mobile and consumer business models.

WHY WE ARE DIFFERENT

We believe that the value-added behind our capital is much more important than the capital itself. Our unique, globally minded platform brings forth an innovative approach to growth stage technology investing.

We know entering new markets can be challenging and often daunting for entrepreneurs, but our platform is proven to consistently deliver strategic results and shareholder value. Our platform delivers strategic and tactical support for business expansion and provides unparalleled access to prospective customers, partners and capital.

Portfolio

Empowering Entrepreneurs to Grow into Global Market Leaders

-

IPO - SHSE:603986

IPO - SHSE:603986 -

IPO - NYSE: U

IPO - NYSE: U -

IPO - SHSE:689009

IPO - SHSE:689009 -

Acquired by Amazon

Acquired by Amazon

-

Latest News

Thoughts and articles on some of our portfolio companiesSee All -

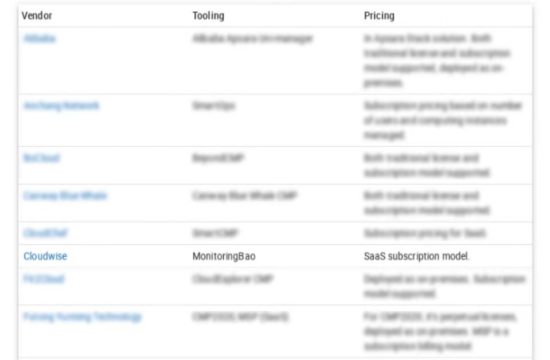

Cloudwise Selected in Gartner’s 2022 China Cloud Management Tools Market Guide

Cloudwise Selected in Gartner’s 2022 China Cloud Management Tools Market Guide

-

Union Optech Opens Office in Torch Development Zone

Union Optech Opens Office in Torch Development Zone